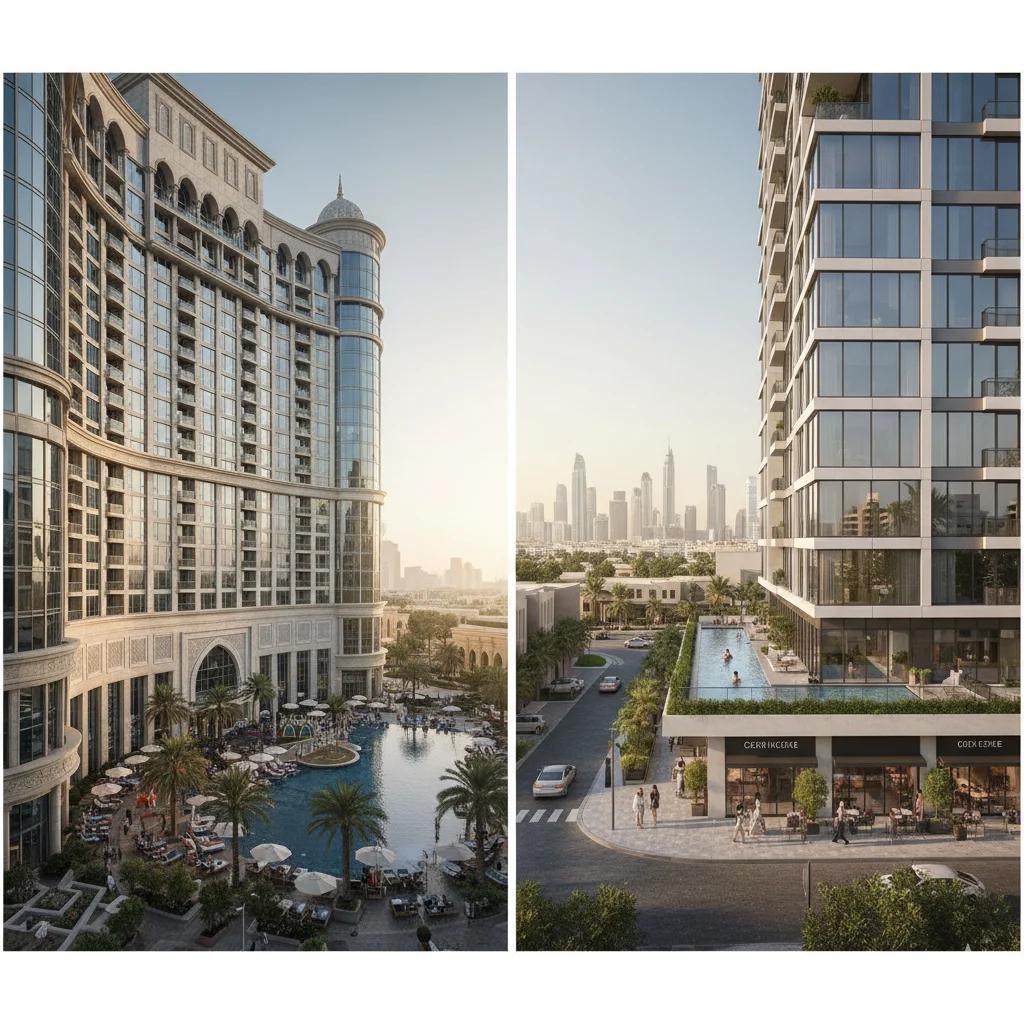

Hotel Apartment vs Serviced Apartment – Key Differences

When searching for profitable property investments or flexible living options in Dubai, two terms often come up: hotel apartment vs serviced apartment. At first glance, they might seem similar — both offer furnished units, premium amenities, and short-term rental options. But in reality, the difference between them can have a major impact on your returns, ownership rights, and lifestyle experience.

In this guide, we’ll break down the key differences between hotel apartments and serviced apartments in Dubai, helping you decide which one best fits your investment goals or living needs.

What Is a Hotel Apartment?

A hotel apartment is a fully furnished residential unit managed under a hotel license. It operates as part of a hospitality brand, such as Hilton, Rotana, or Accor, and is marketed to both tourists and business travelers.

Key Characteristics of Hotel Apartments:

- Professionally managed by a hotel operator.

- Comes with 24/7 housekeeping, concierge, and maintenance.

- Access to hotel facilities like pools, gyms, restaurants, and spas.

- Owners can stay in the apartment or rent it out through the hotel system.

- Revenue is shared between the owner and operator based on an agreement.

This model allows investors to earn passive income while enjoying the reliability of brand-backed management — making hotel apartments in Dubai a top pick for global investors.

What Is a Serviced Apartment?

A serviced apartment is a furnished residential property that offers limited hotel-like amenities but operates more like a traditional long-term rental. It’s ideal for professionals, families, and residents who want flexible living without daily hotel services.

Key Characteristics of Serviced Apartments:

- Typically located in residential buildings with optional housekeeping.

- Managed by property developers or private operators, not hotels.

- Offers longer stay options at lower rates than hotel apartments.

- Residents can personalize the space and utilities.

- Ownership is usually freehold or leasehold under residential property laws.

Serviced apartments give more autonomy and are usually more cost-effective for tenants or long-term investors seeking steady, predictable income.

Hotel Apartment vs Serviced Apartment – Main Differences

Feature | Hotel Apartment | Serviced Apartment |

| Management | Operated by a hotel brand under hospitality license | Managed privately or by real estate companies |

| Target Guests | Short-term tourists, business travelers | Long-term tenants and residents |

| Amenities | Full hotel services (housekeeping, concierge, dining) | Basic services (cleaning, maintenance) |

| Ownership | Commercial property ownership (under hotel license) | Residential property ownership (freehold/leasehold) |

| Rental Model | Revenue shared between owner & operator | Owner rents directly to tenants |

| ROI | 6–10% annually (high yield) | 5–8% annually (steady yield) |

| Flexibility for Owner | Limited personal use (based on hotel agreement) | Full personal control and occupancy |

| Service Level | 5-star hospitality experience | Practical and cost-efficient comfort |

Which Option Offers Better ROI?

From an investor’s perspective, both property types can deliver strong returns, but they cater to different goals: but to understand Hotel Apartment vs Serviced Apartment:

Hotel Apartments – High Yield, Less Control

- Annual ROI: 6–10% depending on location and brand.

- Rental income distributed through the hotel operator.

- Best suited for investors seeking passive income without direct involvement.

Serviced Apartments – Steady Income, More Control

- Annual ROI: 5–8% on average.

- Owners manage leases directly or through agencies.

- Ideal for investors seeking consistent occupancy and personal flexibility.

Example:

A 1-bedroom hotel apartment in Business Bay priced at AED 1.6M could generate 8% ROI annually, while a serviced apartment in Jumeirah Village Circle (JVC) at AED 1.1M could return 6% with stable tenants.

Legal and Ownership Differences in Dubai for the Hotel Apartment vs Serviced Apartment

Hotel Apartments

- Governed by the Department of Tourism and Commerce Marketing (DTCM).

- Operate under a hotel license.

- Usually part of mixed-use or hospitality developments.

- Income is managed through hotel management agreements.

Serviced Apartments

- Classified as residential properties under Dubai Land Department (DLD).

- Owners receive freehold or leasehold title deeds.

- Can be rented short-term or long-term under residential leasing laws.

For foreign buyers, both are accessible — but the legal framework and management terms differ significantly, so reviewing the ownership agreement is essential.

Best Areas in Dubai for Both Investments whether it is a Hotel Apartment vs Serviced Apartment

1. Business Bay

A leading hospitality and business hub featuring luxury hotel and serviced apartments with high occupancy rates and premium brands.

→ Explore: 2-Bedroom Apartments in Dubai

2. Al Barsha

Popular with families and professionals due to its central location near Mall of the Emirates. Ideal for long-term serviced apartment rentals.

→ Explore: Al Barsha Community Profile

3. Jumeirah Village Circle (JVC)

Offers affordable hotel and serviced apartments, perfect for mid-range investors. High tenant demand and steady appreciation.

→ Explore: JVC Community Profile

4. Deira

Combines heritage charm with new hospitality projects. Affordable entry-level investment area for hotel apartments.

→ Explore: Deira Community Profile

5. International City

Strong demand for budget-friendly serviced apartments from expats and working professionals.

→ Explore: International City Community Profile

Advantages of Each Option: Hotel Apartment vs Serviced Apartment

Advantages of Hotel Apartments

- Managed by professional hotel operators.

- High short-term rental yields.

- Global brand recognition.

- Access to hotel amenities.

- Tax-free income and flexible usage.

Advantages of Serviced Apartments

- Greater control over occupancy and rent pricing.

- Long-term tenant stability.

- Lower service fees and operational costs.

- Easier resale and ownership management.

- Ideal for families and professionals seeking convenience.

Average Prices in Dubai

Type | Hotel Apartment (AED) | Serviced Apartment (AED) |

| Studio | 900,000 – 1.3M | 750,000 – 1.1M |

| 1 Bedroom | 1.2M – 2.0M | 1.0M – 1.6M |

| 2 Bedroom | 2.0M – 3.5M | 1.8M – 3.0M |

| 3 Bedroom+ | 3.8M – 6.5M | 3.0M – 5.0M |

Note: Locations like Business Bay and Al Barsha attract premium rates for hotel apartments, while JVC and International City offer more affordable serviced apartment options with reliable yields.

Related Property Options

Explore other profitable investment categories:

- 1-Bedroom Apartments in Dubai

- 3-Bedroom Apartments in Dubai

- Townhouses for Sale in Dubai

- Villas for Sale in Dubai

- Penthouses for Sale in Dubai

Conclusion: Choose the Right Model for Your Goals

Both hotel apartments and serviced apartments in Dubai offer profitable investment opportunities — the key is aligning your choice with your objectives.

If you want a turnkey investment with premium brand management, hotel apartments deliver strong yields with minimal effort. If you prefer control, stability, and long-term tenants, serviced apartments offer predictable income and flexibility.

Whichever you choose, Dubai’s hospitality-driven real estate market ensures strong demand, tax-free income, and global appeal — making it one of the safest and most rewarding property markets in the world.

Start exploring opportunities today and find your perfect investment match in Dubai’s evolving apartment landscape.