How to Rent To Own Property In Dubai?

Rent to own property in Dubai is reshaping how expats and locals secure a home. Instead of paying high rents with no return, you rent now and build equity over time. This model blends leasing with a future purchase option, giving tenants a path to ownership without a hefty down payment. For many, it’s a way to turn monthly rents into an investment rather than sunk costs.

Traditional rentals in Dubai can feel like throwing money away. Mortgages, on the other hand, often demand 20–25% down payment plus fees. Rent-to-own bridges that gap. You sign an agreement that locks in today’s price for purchase later. A portion of your rent then counts toward the eventual property price. Over the lease term, you “rent to buy property in Dubai” and reserve the right to close the deal at a pre-agreed rate.

Here’s why rent-to-own homes in Dubai appeal to so many:

- Lower upfront costs. You start with a security deposit and first month’s rent. No need for a large mortgage deposit.

- Price certainty. The purchase price is fixed at signing, even if market values rise.

- Time to prepare. Use the lease period to arrange finances, improve credit, or move when it suits you.

- Trial stay. You experience the community, amenities, and developer quality before committing long term.

Lease-to-own property in Dubai also tackles common hurdles: sharp price swings, foreigner mortgage limits, and complex paperwork. Developers and agents guide you through the terms, explain Ejari requirements, and outline service charges. You’ll know how much of each rent payment applies to the purchase price and what happens if you decide not to buy.

In this guide, we’ll unpack key points:

- How rent-to-own agreements work in Dubai

- Pros and cons compared to standard renting or buying

- Steps to negotiate terms and protect your interests

- Legal and financial tips for a smooth path to ownership

Whether you’re eyeing a studio in Jumeirah Village Circle or a villa in Arabian Ranches, rent to own could be your gateway to property ownership in Dubai’s dynamic market. Read on to learn if this hybrid approach fits your goals—and how to make it work for you.

How rent to own works in Dubai

Rent to own property in Dubai lets you move into a home today and buy it later. You pay a security deposit, a fixed monthly rent, plus a small premium that builds equity. Over time, that equity counts toward your down payment when you decide to own property in Dubai.

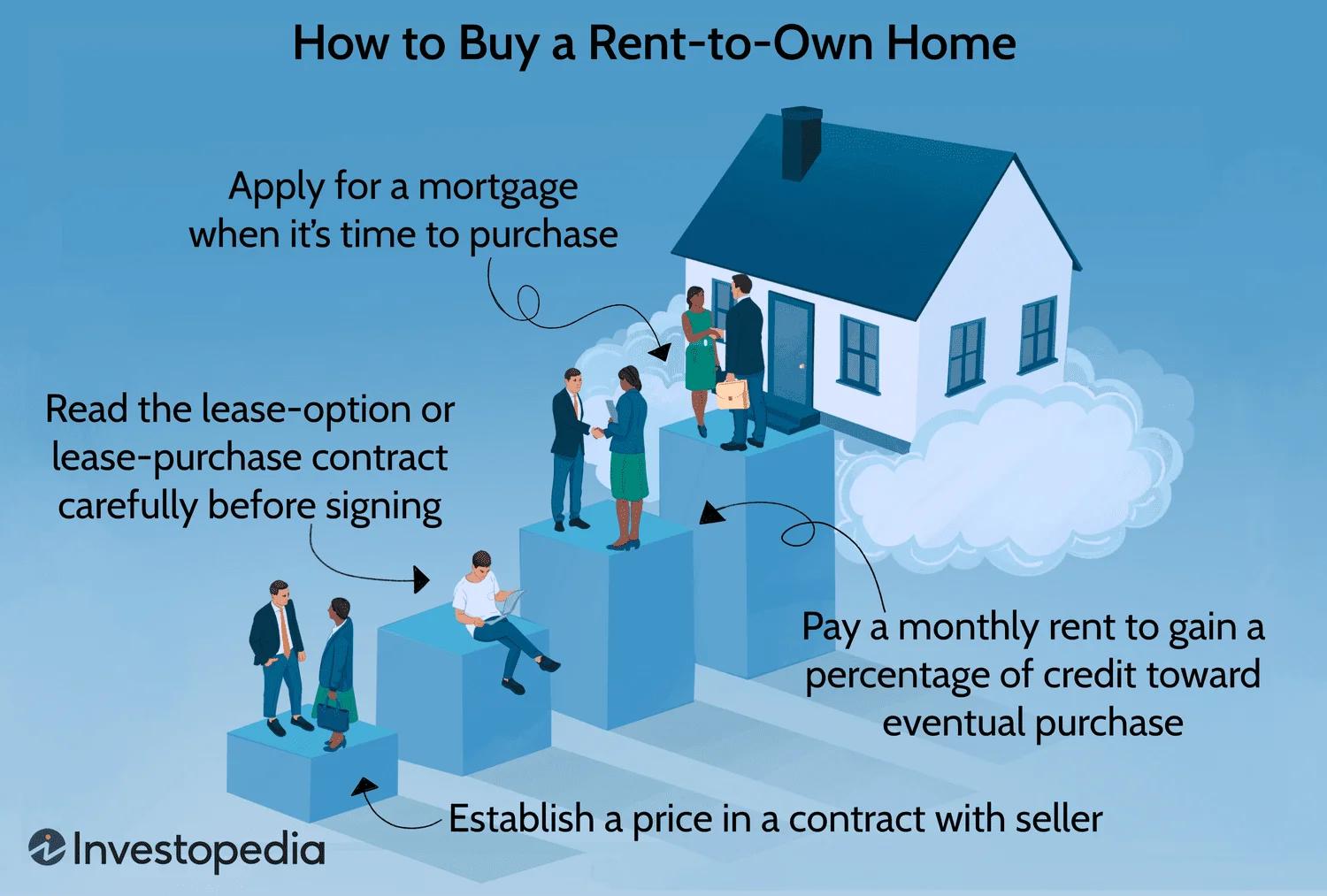

Here’s a step-by-step look at how rent to own properties in Dubai usually operate:

- Option agreement

• You sign a lease‐option contract.

• The contract sets the purchase price and term (often 2–5 years).

• You pay a nonrefundable option fee (1–5% of the sale price).

- Monthly payments

• Part of your rent covers the living cost.

• An extra “rental premium” goes into a escrow account.

• That premium builds credit toward your future purchase.

- Price lock

• You lock in the sale price at signing.

• If the market soars, you still pay the agreed‐upon amount.

- Exercise the option

• Before the term ends, you decide to buy.

• The accrued rental premium reduces your down payment.

• You apply for a mortgage or pay cash balance.

- Walk away or extend

• If you can’t buy, you forfeit the option fee and premium.

• In some plans, you can extend the lease or renegotiate.

This lease to own property in Dubai model helps you secure a home without an upfront down payment. You get time to save, improve credit, and test the neighbourhood. And if you choose not to purchase, you simply move out—no long‐term mortgage binds you.

By choosing rent-to-own homes in Dubai, you blend renting’s flexibility with a clear path to ownership. It’s a smart way to plan your future move in one of the most dynamic markets in the world.

Benefits of rent to own schemes

Rent to Own Property in Dubai plans bridge the gap between renting and buying. They give you time to save while you live in the same home. Here are the main perks of these rent to own apartments in Dubai:

- Lower upfront costs

• You pay a modest deposit instead of a hefty down payment.

• Monthly rent goes partly toward your future equity.

- Build equity as you rent

• A portion of each rent-to-own installment adds to your ownership stake.

• By lease to own property in Dubai, you convert rent into real estate value.

- Lock in today’s price

• The sale price is fixed at the start, shielding you from market swings.

• If prices rise, you still buy at the original rate—ideal for a fast-growing market.

- Flexibility and trial period

• You can test the neighbourhood and the property before committing.

• If you decide not to buy, you simply end the lease—no long-term mortgage binds you.

- Streamlined path to ownership

• Processes like mortgage pre-approval and Ejari registration happen during the lease term.

• You move from tenancy to title deed without repeating steps.

For many expats and families, rent to purchase real estate in Dubai makes the dream of homeownership more within reach. These rent-to-own homes in Dubai offer stability today and ownership tomorrow.

Common models and cost structures

The rent to own property in Dubai market offers a clear path from tenant to homeowner. Under a rent to own model, you pay rent that partly counts toward your future purchase. Here are the most common structures:

- Option fee plus refundable rent credit

- You pay an upfront option fee, usually 2–5% of the agreed purchase price.

- A portion of each monthly rent (often 25–30%) is set aside as rent credit.

- At lease end, you apply accumulated credit toward the down payment.

- Stepped rent credit

- Monthly rent starts lower and rises over time.

- Early payments cover more rent-to-own credit; later payments align with market rent.

- This model suits buyers who expect rising incomes.

- Flat-rate premium model

- You pay a fixed rent premium above market rent, say 10–20%.

- The entire premium goes toward your future equity.

- No separate option fee, but total rent cost is higher.

Cost components to watch in rent-to-own homes in Dubai agreements:

| Cost item | Typical range |

|---|---|

| Option fee | 2–5% of purchase price |

| Monthly rent | AED 80–100 per sq ft |

| Rent-to-own credit | 20–30% of monthly rent |

| Maintenance | Tenant pays service fees |

Key tips for lease to own property in Dubai deals:

- Confirm how much rent actually converts to equity.

- Check if service charges and maintenance fees are extra.

- Clarify end-of-lease purchase price—fixed or market value.

By comparing rent to buy property in Dubai offers side by side, you can pick the model that fits your budget and timeline. Each model blends rent and ownership costs to help you secure your first home in Dubai.

Legal framework and registration

When you explore rent to own property in Dubai, you’re entering a system backed by clear laws and government oversight. The Dubai Land Department (DLD) and Real Estate Regulatory Agency (RERA) set the rules for leasing, owning, and transferring property in Dubai. Registering your rent-to-own agreement with these bodies turns an informal promise into a binding contract. It keeps both tenant-buyer and landlord safe and sets the path for a smooth transfer of ownership.

Here’s how the registration process works under the rent-to-own homes in Dubai model:

- Draft the rent-to-own agreement

• Engage a licensed real estate agent or lawyer.

• Spell out the monthly rent, credit toward purchase, final buy-out price, and the timeline to own the property.

- Obtain a No Objection Certificate (NOC)

• Contact the developer or current owner to confirm there are no unpaid service charges or mortgages.

• Pay the NOC fee (usually AED 500–1,000).

- Register the lease with Ejari

• Submit the signed contract, NOC, and tenant’s passport copy to the Ejari portal.

• This makes the lease enforceable under Dubai tenancy law.

- File with the Dubai Land Department

• Visit a Trustee Office or DLD service center.

• Present the Ejari certificate, title deed copy, signed rent-to-own contract, and payment proofs.

• Pay DLD registration fees: 4% of the agreed purchase price plus AED 580 admin fee.

- Issue of the interim title deed

• Once DLD clears your file, you receive an interim title deed showing your stake.

• This deed confirms your right to convert the lease into full ownership at the agreed time.

Following these steps ensures your rent-to-own properties in Dubai journey stays legal and transparent. Always read every clause before you sign. Watch out for early-termination penalties or transfer-fee surcharges. With the right registration in place, you can turn regular rent in Dubai into an investment that leads you straight to the front door of your own home.

Eligibility and qualification criteria

When you explore rent to own property in Dubai, knowing the eligibility and qualification criteria up front saves time and avoids surprises. Most developers and landlords offering rent-to-own homes in Dubai set clear requirements to make sure you can afford lease to own property in Dubai over the term.

Key criteria usually include:

- Age and residency

• You must be at least 21 years old.

• Hold a valid UAE residence visa or valid entry permit.

- Stable income and salary transfer

• Minimum monthly salary of AED 15,000–20,000 (varies by provider).

• Salary should be transferred to a local bank account for at least 3–6 months.

- Down payment or security deposit

• Expect to pay 5–10% of the agreed purchase price upfront.

• This deposit secures the rent to purchase real estate in Dubai agreement.

- Credit and background checks

• No bounced cheques or outstanding debts recorded with Al Etihad Credit Bureau.

• Employer reference or salary certificate confirming employment status.

- Documentation pack

• Passport copy, visa page, Emirates ID.

• Bank statements (last 3–6 months).

• Proof of address (utility bill or tenancy contract).

For rent to own apartments in Dubai or rent-to-own houses in Dubai, providers often run affordability tests. They calculate your debt-to-income ratio to confirm rent to buy property in Dubai remains within 30–40% of your gross salary. You may also need to secure a No Objection Certificate (NOC) from your employer if you’re on a company visa.

Meeting these standards shows you’re ready to transition from renting to owning. Once approved, you’ll lock in the purchase price today and start paying monthly installments. At lease end, you simply claim full ownership—no hidden fees. This tailored path makes rent to own property in Dubai a realistic option for many expats and GCC nationals aiming to own in one of the world’s most dynamic real estate markets.

Step by step application process

Getting started with a rent to own property in Dubai is simpler than you might think. Here’s how you move from browsing listings to living in a rent-to-own home in Dubai.

- Browse eligible listings

• Visit approved portals or contact agents offering rent to own properties in Dubai.

• Filter by location, budget, and property type—apartments, villas, or townhouses.

- Submit an initial inquiry

• Fill out a short online form or call the agent.

• Share your basic details: name, current address, employment status, and monthly rent capacity.

- Reserve your unit

• Pay a small reservation fee to lock in the property.

• This fee is usually deducted from your future down payment.

- Complete the application

• Provide documents: passport copy, Emirates ID, salary certificate, and bank statements.

• Review the rent-to-own agreement carefully. It outlines monthly rent, tenure, and the final purchase price.

- Undergo eligibility check

• Your agent or developer will run a credit and background check.

• Approval often takes 3–5 business days.

- Sign the agreement

• Meet at the developer’s office or trustee centre.

• Sign the lease to own property agreement and pay the first month’s rent plus any service charges.

- Move in and build equity

• You can move into your chosen home in Dubai once all fees are settled.

• A portion of each rent payment goes toward the future down payment, helping you own the property outright at term end.

Every step keeps you in control—no big lump-sum down payment up front. By following this process, you’ll find a clear path from renting to owning in Dubai’s competitive market. Ready to explore rent to purchase real estate in Dubai? Start your application today and secure your future home.

Tips for a smart rent to own decision

Before you commit to a rent to own property in Dubai, take a step back and do your homework. A clear plan helps you avoid costly surprises down the road. Use these tips when you explore rent-to-own homes in Dubai:

- Verify the contract details

Read every clause in the lease to own property in Dubai. Note the option fee, monthly rent credits and final purchase price. Don’t skip the fine print on service charges or maintenance costs.

- Choose the right location

Look for a community that fits your lifestyle and budget. Think about schools, public transport or retail options. Areas with planned infrastructure upgrades often boost capital growth.

- Crunch the numbers

Compare total rent-to-purchase costs against a straight rent or mortgage. Factor in rent credits, deposit refunds and market value shifts. A simple spreadsheet can show if rent to buy property in Dubai makes sense.

- Inspect or research off-plan projects

If it’s a ready apartment, book a site visit. For off-plan units, check the developer’s history and delivery record. Ask for an Ejari-registered tenancy contract.

- Plan your exit strategy

Know your options if you decide not to buy at lease end. Can you sublease, transfer the option or walk away with no penalty? Having a fallback path keeps you in control.

Working with a licensed real estate advisor and a property lawyer will keep you on track. These experts know Dubai’s rules for owning property and freehold zones. Follow these steps to turn a rent to own properties in Dubai offer into a winning move.